Trademarks (specifically mascots, brandnames, taglines and or logos) are types of intellectual property business asset. Their raison d'etre is to unmistakably identify their intellectual source; you. A trademark that is doing its job prevents confusion in the mind of consumers regarding the source of their intellectual property. From a marketing perspective; they help to differentiate your brand; lower customer acquisition costs; create trust (an important aspect of customer relationship building) and promote brand awareness, loyalty and competitive advantage. In fact, your intellectual property can even become a valuable and resellable proprietary asset. Consequently, this mental shortcut to your brand should therefore be protected, much like one uses insurance over other business assets. If you invest time and effort to build a brand, it will never be too early to secure it. One of the key risks against which protection of intellectual property provides includes unfair competition through theft and or new marketplace entrants. This protection is provided through registration of your trademark with a governing body. Consequently, if faced with threats on your intellectual property rights, you can exercise the legal right to make demands.

Just to be clear, there are no legal obligations for registering trademarks. For instance, a business may conduct business with a trademark without registering it legally in any office without any problem. In such a case, that business simply places the letters 'TM' after the brandname (or 'SM' for services). However, such a business runs the risk of missing out on powerful legislative rights to protect you in the event of attack or innocent cases that require resolution of confusion between sellers. Since trademarks are designed to ensure that consumers are never confused over who they are getting a product from. Consequently, your trademark is likely to win if some form of confusion arises that requires one company to step back.

From this point, this post discusses trademark registration, how to do it and key considerations.

As a general rule, there is no one-step method of automatically protecting your trademark for all countries. Consequently, if you want protection in 7 foreign countries and want intellectual property protection there, you might need to request the counsel, ie the help of trademark lawyers in each of those foreign countries to protect / register your trademark.

However, the Madrid Treaty presents an exception to this rule. The Madrid Protocol Treaty (aka Madrid System of 'international registration') allows its members to use a single, standardized application for obtaining protection in multiple member countries and or regions. Members not only include individual countries but also groups of countries that the agreement treats as 'single countries'. Such regional groupings include the European Union (EU), the BeNeLux (comprising Belgium, the Netherlands and Luxembourg) and the African Intellectual Property Organization (OAPI).

Some benefits of membership and international application include:

- Cheaper application and renewal

- One-stop application and renewal of the registration

- One-stop administration for tasks that include name changes and so on.

- You can make subsequent applications to further extend the initial international registration to include other countries. (Beware however because if the addition of additional countries occurs shortly before the overall registration expires, it might be better to apply for registration for new countries individually because their registration will be limited to the time period of your overall registration. Otherwise, you might need to wait until the registration expires before adding additional countries.)

Disadvantages may include:

- Sometimes, it ends up being more costly than expected. This occurs if a single member rejects an application. Such rejections will require you to revert to seeking local counsel to deal with the rejection.

- The World Intellectual Property Organization (WIPO, aka 'OMPI' in French and Spanish) international registration applications are subject to the 5-year 'Central Attack' policy that establishes a dependence of foreign registration on home registration for the first 5 years. For instance, if your 'home country' is in the US and your application has been denied at home (in the US), all the other WIPO applications will be automatically denied. In short, although applying to a group is cheaper, more efficient and usually proceeds without problems, it is sometimes advantageous to forgo your benefits of membership to the Madrid Protocol by just applying one country at a time. On this basis, invest extra time to investigate the potential risks associated with your home country before making group applications.

- The trademark can not be changed. For instance, you can not change the spelling or the goods and services listed in your original registration.

BTW since businesses from non-member countries can not apply for international protection using the Madrid Treaty (requiring them to apply to all individual '7' countries as per the example above), their common workaround is to set up a branch in a member country just for this type of purpose.

In short, if your company's home country is a Madrid Protocol member, you can pursue the single, standardized application for international registration / protection using the WIPO application process. The WIPO's 'International Bureau' maintains the single international registry (or database). That single application is automatically forwarded to all the member countries in which you expressed an interest. Each country's local counsel reviews the application and responds. You will need to pursue a separate application at the level of a single country within a group (like the EU) only if that country's counsel rejected you original WIPO application.

- Familiarize yourself with the definitions and laws related to trademarks. The definitions will help you to be clear regarding the correct legal term of the instrument you require. For instance, you can avoid errors by learning the subtle difference between trademarks ('marcas') and 'commercial names' (aka 'company names' or 'ficticious names'). For the sake of clarity, the concept of commercial names is discussed briefly only after this post as an extra note because this post focuses exclusively on trademarks).

- Contact the Intellectual Property rights department of your country's national registry to perform preliminary research.

- Regardless of whether your country qualifies for international applications; start investigating potential risks of confusion assocated with the registration in your home country.

- Seek out access to the intellectual property registry database specific to your country at all levels. For instance, in the US, federal databases may not include state-level information ... and vice versa.

- Specifically request assistance for finding cases that are in process. This is key because, in some countries, databases available to the public do not share information about cases that are not listed despite being unavailable, for many reasons that include trademark inactivity that has resulted in a grace period during which owners still have preemptive rights ahead of anyone else and can therefore still reclaim the trademark. NB; this step should never be overlooked, even if you are more interested in selling internationally. As mentioned above, the success of your home application will affect those of other countries if you pursue the international registration option. Although there is assistance to show you how to search their database, the office will usually not provide full scale preliminary, legal assessments before you formally apply. However, take full advantage of whatever free assistance you can get. The search takes a lot of time and effort that should be considered a reasonable investment into the reputation of your business. For instance, in the US, after using easier types of searches like common internet search engines to find use of similar trademarks, it will be wise to review the secretary of state registries for all US states. That is a lot of work but worthwhile for knowing what is in the market in the form of registered and non-registered aka 'common law' trademarks. You can also save yourself considerable money and time because your application may be rejected if your proposed trademark causes confusion with another listing.

- If you are interested in protecting your trademark in countries other than your home country, conduct the following research. Do this regardless of whether you are interested in and your country qualifies for international applications

- As an option, consider getting professional help. Some options for professional help of attorneys include the following.

- Trademark Factory. I like the fact that they allow you to even schedule free qualification meetings, ie in addition to having a live chat function on their website (though I am unsure of its schedule of operation). They also boast a flat fee that saves customers the headache of uncertain cost spikes that can unexpectedly arise during the registration process.

- Research the availability of (brand) names on the World International Intellectual Property Organization (WIPO) website continuously updated database from multiple national and international sources, including trademarks, appellations of origin and official emblems.

- Research trademarks using other free online tools like TM View that keeps a database for the primarily the EU but also elsewhere. I find this resource easier to use and understand (than the WIPO database).

- Determine the applicable Nice Class (NC) / Clase de Niza (CN), ie an international classification system used to classify goods and services for the purposes of the registration of marks. Example, non-medicated cosmetic products have a class number of 3. The PDF downloadable information about this class of product provides full details which you can use to ascertain whether you have chosen your class correctly. You can select multiple classes. The NC indicates the scope of protection your mark can receive. NB Third parties are allowed to use similar or identical brands, but only if their goods and services are registered under other Nice classes and there is no risk of confusion, association or loss of reputation. (Famous brands like Coca Cola are an exception as their protection transcends the Nice classification system.

- Collect all the relevant documents and information required to file a valid application. Noteworthy points include the following. Avoid common mistakes.

- Owner: Should be ONLY the business and NOT the person(s) filing the application.

- Differentiate between goods

- Other key details required in the application process. See instructional videos provided by the US Patent & Trademark Office (USPTO).

- Conduct an international application if you qualify, ie if your home country is a member of the Madrid Protocol.

- Check whether your country is a current member of the Madrid Protocol.

- Before doing this step, conduct preliminary research as mentioned above regarding the availability of the desired trademark(s) in all the relevant countries, including your home country.

- Wait and remain contactable during the review period by a legal team. Your application does NOT guarantee approval and registration because your applpicant details must be studied and compared, not only with pre-existing registered trademarks but also with other current applications in the office's application pipeline. Review periods may take as many as several months. The objective of the legal team is to ensure that your trademark does its job, ie it does not cause confusion in the mind of consumers. Be prepared to submit additional documents if required as in some cases.

|

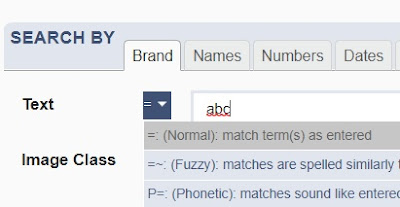

Select the 'brand' tab. Type a name. In this example, 'abd'. As an option to simply entering 'Search', you can use the dropdown menu in the field to filter the search according to how well the proposed name matches other brands. Results will appear to the bottom of the page. |

If the name of another brand is similar or the same (in any way, including sound), notice its Nice Class (NC) to determine whether you can proceed without causing any chance of confusion between the brands. In this fictitious example, this mark is registered under the NC 3 for cosmetics. If uncertain, investigate the other brand to understand the product offering. Be mindful of potential overlaps in classes that might cause confusion. In that case, if in doubt, review not only your proposed class but also that of the other brand. Additionally, consider applying for all classes to which your mark can apply.

CASE STUDY ON BRAND RISK MANAGEMENT

The following case study illustrates why having control of one's intellectual property is critical consideration for brand risk management. (Risk management 101). McDonald's lost its product brand rights in Europe in 2019. During that time, competitors took full advantage with the following types of advertisements. To avert this type of problem, brand managers should have reminders and the wherewithal to avoid this brand risk by renewing the rights on time.

CONTENT RELATED TO REGISTERING A TRADEMARK

- While you may register a trademark on your own, some countries require an intellectual property lawyer in order to registering a 'company name' aka a 'fictious name' or 'doing business as / DBA' name. Just to clarify, a 'company name' is an officially recognized name that is usually more informal, more recognizable and commonly used, much like having an officially registered nickname (or what is called a 'fictitious name' in some US states). Customers might find it easier to remember 'Yum Yum' for an eatery but not your company's name 'MBR & Sons Ltd'. (Unlike trademarks, commercial names must be done in person)

- After your register and protect your brand's trademark, you can rest assured that it will help you build brand awareness.

- Branding 101

- All things 'Branding' (Brand mascot, etc)

- Protecting intellectual property is only one form of risk maangement to consider. Read more about risk maangement.

- While this post focuses mostly on tradenames, an application can include anything that identifies your brand as in the case of the following.

- Trademark symbols (which include logos).

- Trademark sounds (aka 'sound marks')

- MGM's roaring lion (technically a 'service mark')

- NBC's chime

- Homer Simpson's "D'Oh!"

- The Lone Ranger

Trademark packaging

- Coco Cola's bottle

- (Attributing creative commons)